The Definitive Guide to Home Appliances Insurance

Wiki Article

A Biased View of Home Appliances Insurance

Table of ContentsLittle Known Facts About Home Appliances Insurance.The Ultimate Guide To Home Appliances InsuranceThe Main Principles Of Home Appliances Insurance Getting The Home Appliances Insurance To Work5 Simple Techniques For Home Appliances InsuranceSome Known Questions About Home Appliances Insurance.

Certified guarantee business have a Construction Professionals Board (CCB) permit number. We can confirm that number for you. Give us with duplicates of document or documentation you receive from the business so we can help them follow the regulation.Have you ever before wondered what the distinction was in between a home warranty and residence insurance? Both shield a house as well as a property owner's wallet from pricey repair services, yet exactly what do they cover? Do you require both a residence warranty as well as residence insurance, or can you get simply one? All of these are outstanding inquiries that numerous house owners ask.

What is a home warranty? A house guarantee safeguards a house's internal systems as well as devices. While a residence warranty agreement is comparable to home insurance, specifically in how a property owner uses it, they are not the very same thing. A homeowner will certainly pay an annual premium to their residence guarantee business, usually in between $300-$600.

The Ultimate Guide To Home Appliances Insurance

If the system or home appliance is covered under the house owner's residence warranty plan, the residence service warranty business will send out a service provider that concentrates on the repair service of that particular system or home appliance. The homeowner pays a flat rate solution call fee (normally in between $60-$100, depending on the house guarantee firm) to have the specialist come to their residence and also detect the issue.What does a house service warranty cover? A house service warranty may additionally cover the larger home appliances in a residence like the dishwashing machine, stove, refrigerator, garments washing machine, and clothes dryer.

Home Appliances Insurance Can Be Fun For Anyone

Residence insurance may additionally cover medical expenditures for injuries that people suffered by getting on your home. A house owner pays a yearly costs to their home owner's insurance policy business. Generally, this is someplace in between $300-$1,000 a year, depending on the plan. When something is harmed by a disaster that is covered under the residence insurance plan, a property owner will call their residence insurance policy firm to sue.House owners will generally have to pay an insurance deductible, a fixed amount of cash that appears of the house owner's purse prior to the home insurance provider pays any kind of cash towards the case. A house insurance deductible can be anywhere in between $100 to $2,000. Generally, the greater the insurance deductible, the lower the weblink yearly costs price.

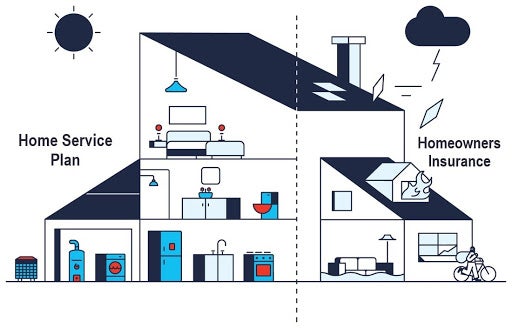

What is the Distinction Between Home Guarantee and also Home Insurance Policy A house service warranty contract and a residence insurance policy run in similar methods. Both have an annual costs and a deductible, although a residence insurance policy premium and also insurance deductible is frequently a lot greater than a house guarantee's. The main differences between home guarantees as well as house insurance policy are what they cover (home appliances insurance).

See This Report on Home Appliances Insurance

:max_bytes(150000):strip_icc()/AFCHomeClubforonlinequotingAmericas1stChoice-5a83096943a1030037423d8f-1-083605c6c9e2413d83a66c98dced822b.png)

If there is damages done to the framework of the house, the owner won't have to pay the high expenses to fix it if they have house insurance policy (home appliances insurance). If the damages to the click over here now residence's framework or property owner's valuables was brought around by a malfunctioning appliances or systems, a house guarantee can assist to cover the expensive repair services or replacement if the system or appliance has actually stopped working from typical wear and tear.

They will function with each other to supply defense on every component of your house. If you have an interest in buying a home service warranty for your residence, take an appearance at Landmark's house service warranty strategies and pricing below, or demand a quote for your residence right here (home appliances insurance).

The Ultimate Guide To Home Appliances Insurance

"Nevertheless, the much more systems you add, such as swimming pool coverage or an additional home heating system, the greater the cost," she states. Adds Meenan: "Costs are commonly negotiable as well." Other than the yearly cost, house owners can expect to pay on typical $100 to $200 per service call see, depending upon the kind of contract you acquire, Zwicker notes.

"We paid $500 to register, and afterwards needed to pay another $300 to clean the primary drain line after a shower drain backup," claims the Sanchezes. With $800 expense, they thought: "We really did not profit from the house warranty whatsoever." As a young pair in an additional house, the Sanchezes had a tough experience with a house warranty.

Excitement About Home Appliances Insurance

When the technician had not been satisfied with an analysis he obtained while checking the heater, they state, the company would not consent to coverage unless they paid to replace a $400 component, which they did. While this was the Sanchezes experience years ago, Brown confirmed that "checking every major device prior to offering protection is not an industry criterion."Always ask your carrier for clearness.Report this wiki page